uber eats tax calculator nz

TikTok video from Edris ed_or_edris. How is this handled.

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

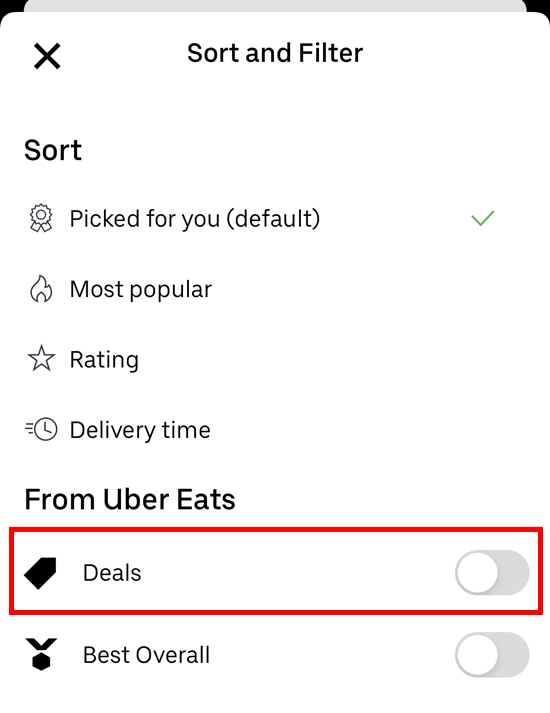

If you want to get extra fancy you can use advanced filters which will allow you to input.

. Well send you a 1099-K if. Average income for Uber drivers will vary on the circumstances of each driver but an average income of 25 to 35 per hour after Uber takes its cut is about average. On average a typical Uber Eats driver can make 15 or more per hour.

Expenses to come off drivers earnings will be anywhere from approx 25-50 depending on individual circumstances. In the US Uber claimed driver partners could make between 70000 and 90000 pa but the average income appears to be closer to 15 to 25 per hour. Calculate your tax return quickly with our easy to use tax calculator.

You guys can do it too prop22 BAYAREA ubereats fyp uber california foryoupage. I made 965703 in 30 days ubereats excluding gas and taxes. As a self employed person you pay both halves.

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. The average number of hours you drive per week. Dont rely on Ubers figures for mileage.

You make estimated quarterly payments without needing any documents from Uber. I would keep all of your expenses and mileage in a spreadsheet. Answer 1 of 6.

You a driver make a car available for public hire for passengers. However much of this is similar for other gigs like. Fees paid to you when you provide personal services are taxable income.

Select your preferred language. Ride-sharing sometimes referred to as ride-sourcing is an ongoing arrangement where. All you need is the following information.

Uber also issues quarterly statements which dont line up with the above. There are also the variable factors of major repair bills. Can claim certain expenses as income tax.

As an independent provider of transportation services you will be responsible for your own taxes when driving for rideshare companies. Average Uber Eats Pay Per Hour. Phone is monthly 110 total.

Uzochukwu From your question I am assuming you are a new driver to Uber. Recent research shows that Australians spend over 26 billion each year on food and drink delivery through. Do I just divide by 4 to get weekly.

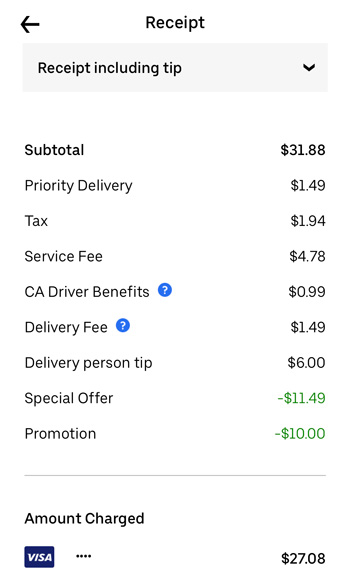

Using Uber as an example your total or gross revenueturnover will be the fares that the customers pay standard fares surge cancellation fees waiting time booking fees airport tolls. Uber Eats has dropped its commission fees cap 5 per cent to 30 per cent. During special events and busy periods drivers sometimes make substantially more than that.

If an employee on your payroll earns more than the maximum well only levy you for the maximum. This includes revenue you make on Uber rides Uber Eats and any other sources of business income. The amount of money an Uber Eats driver makes per hour greatly depends on the city theyre serving.

Tax Deductions for Uber Eats and Other Delivery Drivers By HR Block 6 min read According to statistics busy Australians have an obsession with food delivery. A passenger uses a third-party digital platform such as a website or an app to request a ride for example Uber Zoomy or Ola. Certain states have implemented lower reporting thresholds.

Maximum liable income for employees. Someone on the. Your 1099-K is an official IRS tax document that includes a breakdown of your annual on-trip gross earnings.

Learn more on irsgov. Uber Drivers Lyft drivers and other rideshare drivers. Income tax and GST.

You may also have to pay goods and services tax GST. Being a food delivery driver for other gigs like Doordash Grubhub Instacart etc. The city and state where you drive for work.

This Uber Eats tax calculator focuses on Uber Eats earnings. According to financial accounts filed with the New Zealand Companies office Uber declared gross revenues of 1061018 in New Zealand in 2014 but paid just 9397 in income tax. You use the car to transport the passenger for a fare.

Therefore you might receive a 1099-K for amounts that are below 20000. Order food online or in the Uber Eats app and support local restaurants. This is based on average earnings after the Uber fee of 25-35 per hour.

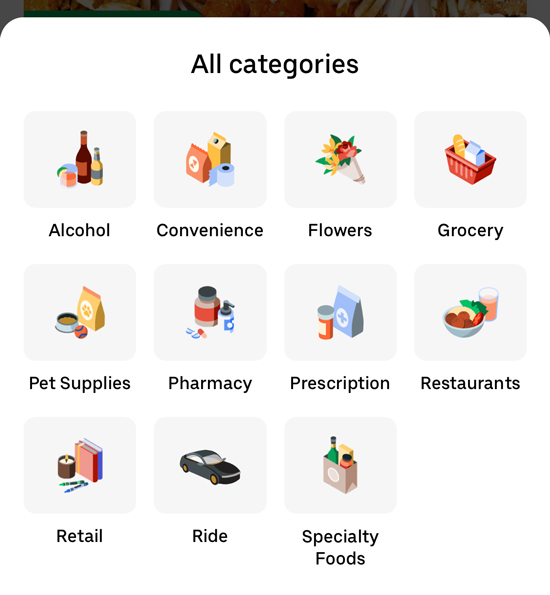

Year starting from 1 April. I am doing uber eats and need to lodge my tax. Get contactless delivery for restaurant takeaway groceries and more.

Then you also pay income tax just like an employee but only on 80 of your profits if you make over 12k. For example I turn on my app when I. Using our Uber driver tax calculator is easy.

I still committed Ubereats 30 day 965703 excluding gas and taxes. But now as restaurants try to recover and reopen in a limited capacity more sustained measures are needed to provide. However Ubers tenure on this side of the world has not been without controversy.

Youll only pay levies on an individuals earnings up to the maximum level. Find the best restaurants that deliver. This article is not meant to completely explain taxes for Uber Eats drivers.

Because I actually only earn 5000. I cant easily calculate my usage as I check my Uber apps daily but only work casually when I feel like it. A study conducted by the Centre for Future Work at the Australia Insitute showed that drivers often earned AU18.

Arabic Azərbaycan Bahasa Indonesia Bahasa Melayu Čeština Dansk Dari Deutsch Deutsch Austria Eesti Keel English English British Español Español España Français Français Canada Hrvatski Hungarian Italiano ಕನನಡ Lietuvių Nederlands Norsk Bokmål Pashto Polski Português Brasil Português Portugal Pусский Română. If youre providing your time labour or services through a digital platform for a fee you. So you pay 153 of this so called self employment tax.

Remember you will make more money depending on the time and the days you choose to deliver food. Uber pays weekly which is great for you spreadsheet. It is important that you keep all of your mileage.

Must declare all income you receive in your tax return. If you employ staff. I recieved summary from Uber I am still confusing with about fare breakdown 8000 and potential deduction uber service fee 3000 how much should I put on my tax declaration 5000 or 8000 with 3000 deduction.

Your employer pays the other half. Your average number of rides per hour.

How To Make 100 A Day Driving Uber Quora

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

How Much You Ll Make As An Uber Driver Calculator Finder Com Au

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Marriott Bonvoy 1 000 Bonus Points For Linking Account With Uber One Transaction By March 20 2022 Loyaltylobby

How Much You Ll Make As An Uber Driver Calculator Finder Com Au

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Uber Pm Interview Guide Questions Process And Prep Igotanoffer

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Marriott Bonvoy 1 000 Bonus Points For Linking Account With Uber One Transaction By March 20 2022 Loyaltylobby

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Uber Tax Summary Information For Driver Partners Uber Uber Blog

Marriott Bonvoy 1 000 Bonus Points For Linking Account With Uber One Transaction By March 20 2022 Loyaltylobby

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

Connect And Parcel Deliveries Pilots Uber Blog

How Much You Ll Make As An Uber Driver Calculator Finder Com Au