rhode island sports betting tax rate

Rhode Island sports betting revenue is taxed at a rate of 51. The exceptions to the rule are Delaware New Hampshire and Rhode Island which all have rates around 50 percent and Pennsylvania with a 34 percent rate.

Mobile Sports Betting Bill Advances In Rhode Island House

4 Rhode Island Sports Betting Tax.

. Sports betting tax revenue by State for 2020. As it is run by the state the Sportsbook Rhode Island online bookie only applies a 599 tax on gambling revenues. Rhode Island Sports Betting Laws And Tax Rates Rhode Island was one of the first states in the US to offer sports betting launching in 2018 via retail outlets.

Nevada has one of the lowest tax. Rhode Island has offered legal online sports betting since March 2019. Rhode Islands sports betting industry generated 187m in revenue for the 2019-20 fiscal year despite the impact of the coronavirus pandemic.

Rhode Island has set a new state record for sports wagering revenue in the month of November the Rhode Island Lottery reports. Rhode Island Online Sports Betting. Facilities are required to withhold 24 of your earnings for.

We take a look at the top 5 earners and breakdown each states earnings by month. State 51 IGT 32 Casino 17 What You Can Bet On In Rhode Island. This leads to much more attractive odds than the retail bookies.

If you receive cash from a sports betting facility you will receive a total that already has taxes taken out of it. When it comes to taxes Rhode Island has adopted a revenue-sharing framework with the commercial casino operators. Rhode Island also became the state with the highest tax rate according to the law sports betting profits will be split between the state the states gaming operator and the.

How to Bet in Rhode Island Register online. Rhode Island Sports Betting is here. Rhode island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting.

How States Tax Sports Betting Winnings. Pennsylvania has a massive 36 percent effective tax rate on top of a 10 million initial licensing fee. The state receives 51 of the sports betting revenue generated.

Delaware and Rhode Island both have a revenue-sharing model where revenue is shared between state casinos and operators. If a player loses 100 on a sports bet the state will keep 51 IGT will get 32 and Twin River will get 17 but those rates do not sit well with critics. Rhode Islands tax rate is an unbelievable 51 percent.

Tax rates are built with the goal of getting each state enough. How States Tax Sports Betting Winnings. You should also expect to pay another 24 in federal taxes.

However as of October 2020 it only features one operator state-run Sportsbook. High tax rates hinder the. States have set rules on betting including rules on taxing bets in a variety of ways.

The Rhode Island Lottery takes 599 of all the total winnings. According to the latest figures. Rhode Island betting sites and legal history.

The Ocean State collected 63 million in. Heres a look at Nevada sports betting handle and revenue since June 2018 the month that the first sportsbooks opened in other states. Tax Rate.

Sports betting is legal in Rhode Island and residents have the option to use the domestic.

Assessing State Sports Betting Structures Aaf

Sports Betting Tax 2022 Do You Pay Tax On Sports Betting Winnings

A Pair Of Pennsylvania Casino Operators Blink First Buy Costly Sports Gambling Licenses In High Tax State Cleveland Com

Opinion Sportsbooks Might Hate It But Ny Winning Sports Betting Game

Sports Betting In Massachusetts Could Affect Nh Revenues

Lotteries Casinos Sports Betting And Other Types Of State Sanctioned Gambling Urban Institute

Three Tax Lessons From The First Year Of Widespread Legal Sports Betting Tax Policy Center

![]()

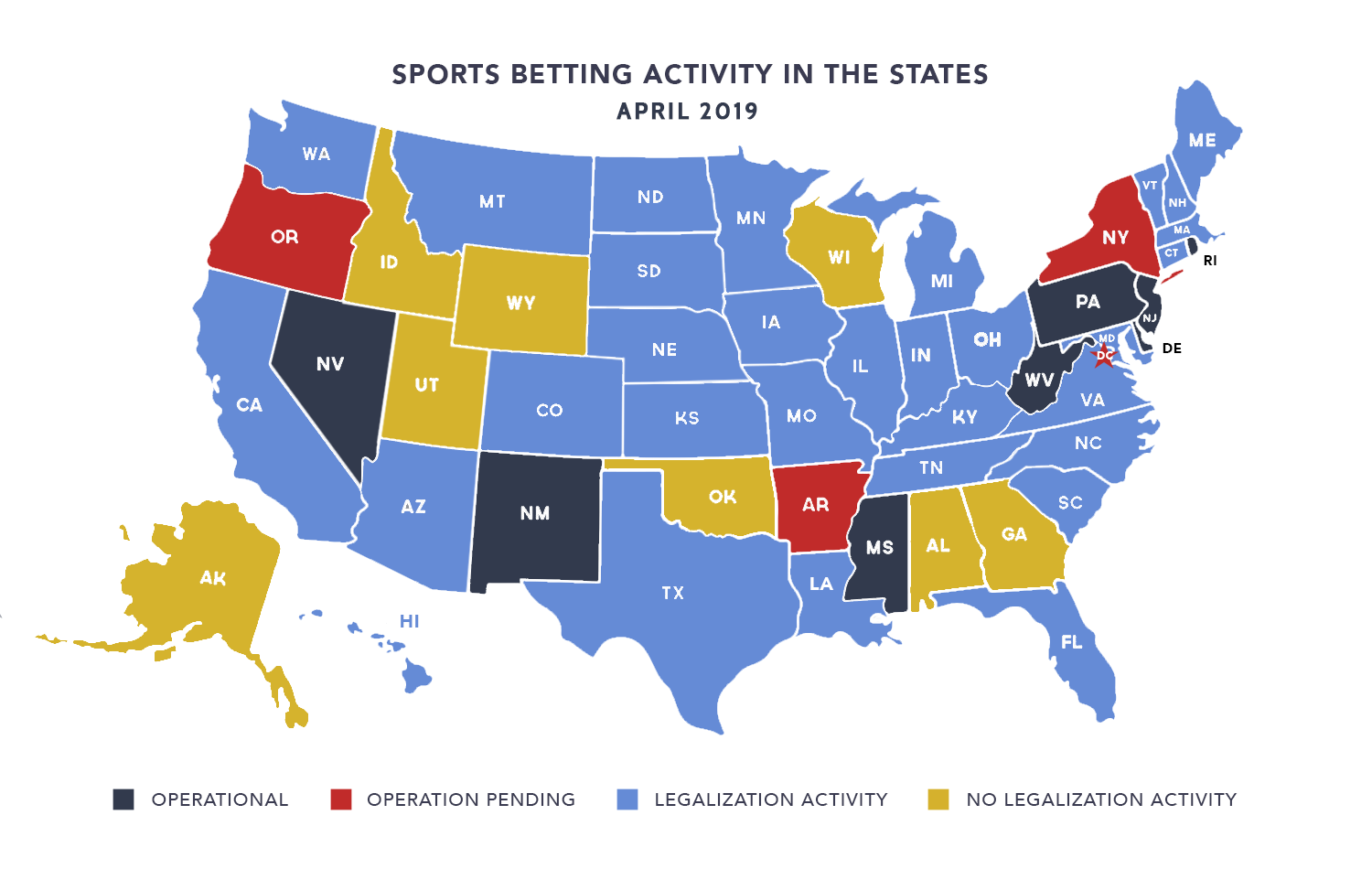

When Will My State Legalize Sports Betting Map Of Sports Gambling Legislation Across The Us

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Tim Steller S Column Arizona S Capped Tax Rate On Sports Betting A Dumb Idea

Sports Betting Will Be No Home Run For State Budgets Wwltv Com

Rhode Island Sports Betting Market Books Record June Revenues

Online Sports Betting In Rhode Island Potential Revenue And Growth

Legalized Sports Betting May Not Be A Sure Thing For Rhode Island Rhode Island Monthly

Regional Rivalries Arise In Dash For Sports Gambling Cash The Pew Charitable Trusts

Rhode Island American Gaming Association

Three Tax Lessons From The First Year Of Widespread Legal Sports Betting Tax Policy Center

2019 Trends In Sports Betting Legislation Taxes Down Mobile Up